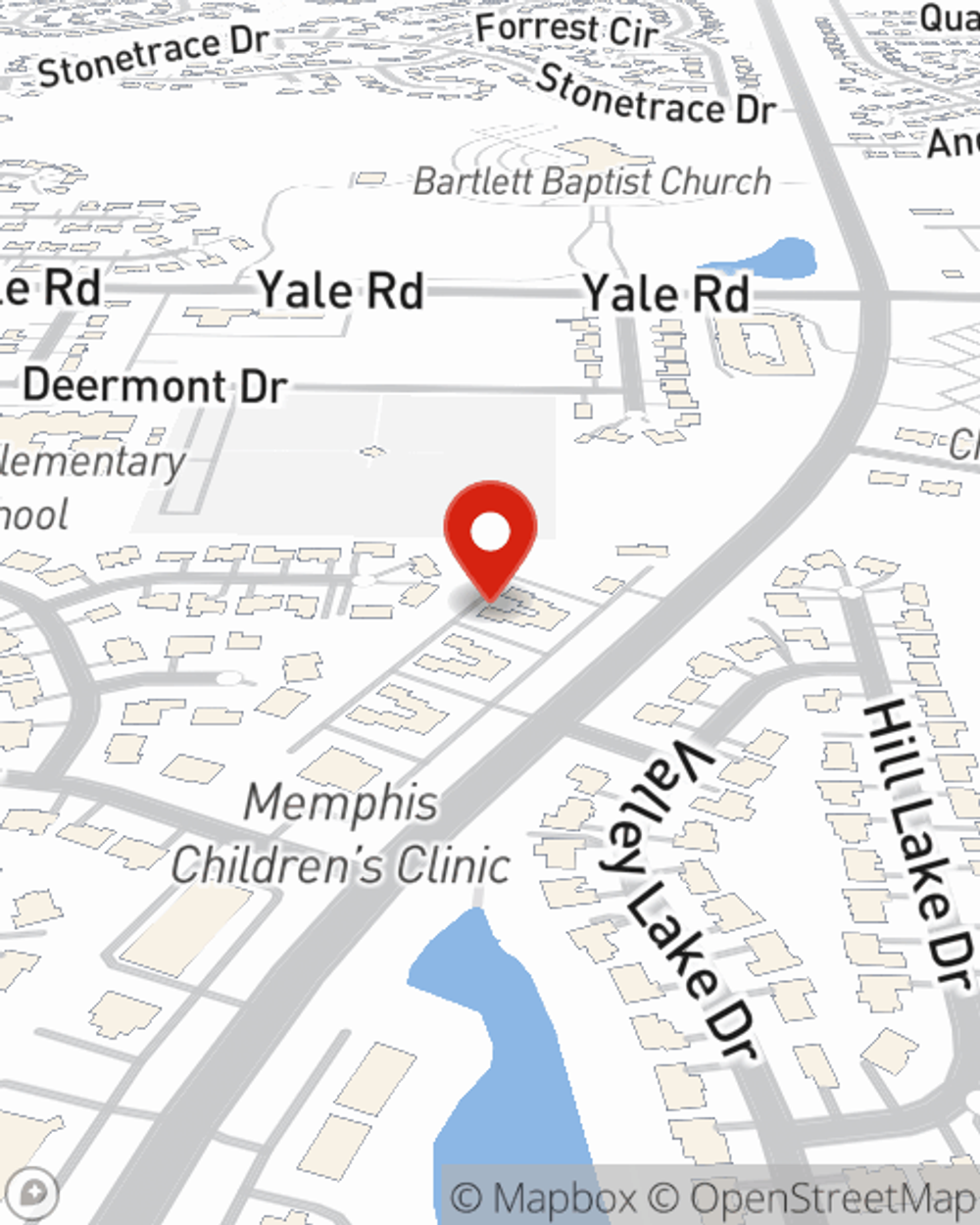

Renters Insurance in and around Bartlett

Bartlett renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's a condo or a townhome, protection for your personal belongings is a wise idea, whether or not your landlord requires it.

Bartlett renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Agent Jeff Herman, At Your Service

It's likely that your landlord's insurance only covers the structure of the home or townhome you're renting. So, if you want to protect your valuables - such as a video game system, a bedding set or a set of favorite books - renters insurance is what you're looking for. State Farm agent Jeff Herman has the knowledge needed to help you understand your coverage options and protect yourself from the unexpected.

Don’t let the unknown about protecting your personal belongings keep you up at night! Call or email State Farm Agent Jeff Herman today, and explore the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Jeff at (901) 388-4402 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Jeff Herman

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.